Home Office Deductions - Quintessential Tax Services - US and International Tax Services, and Consultation

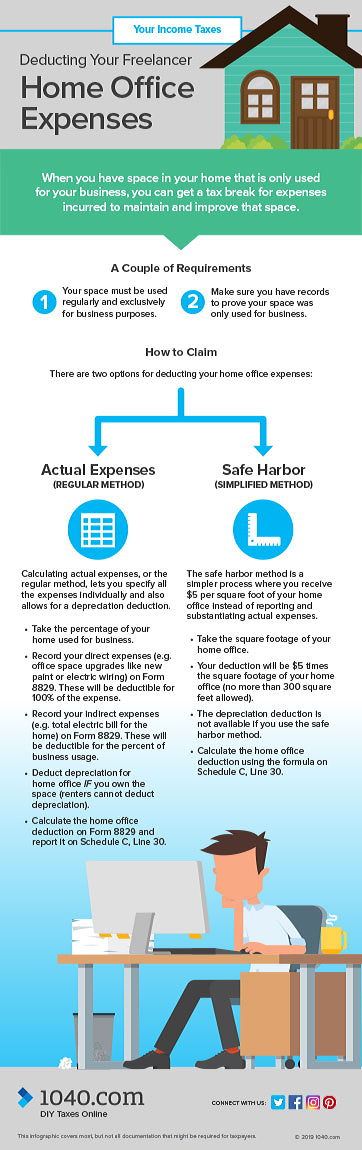

Taj Accounting and Tax Services - If you're an employee working from home due to #COVID19, there are 2 methods to claim the home office expenses deduction: House buildings Temporary flat rate —

.jpg)

:max_bytes(150000):strip_icc()/450824025-F-56a938665f9b58b7d0f95be1.jpg)

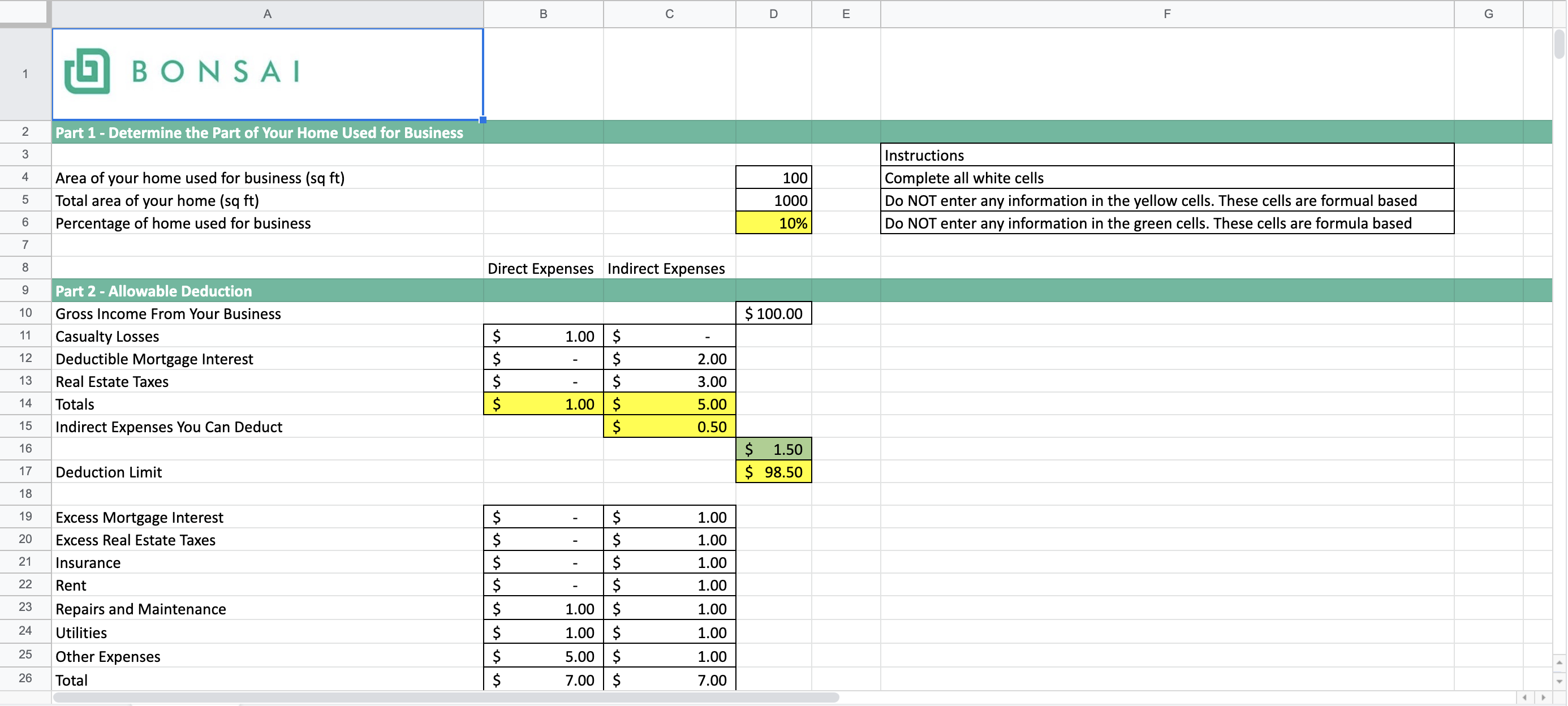

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png)

:max_bytes(150000):strip_icc()/148241359-58a486005f9b58819cb423b1.jpg)

![Can I Take the Home Office Deduction? [Free Quiz] Can I Take the Home Office Deduction? [Free Quiz]](https://assets-global.website-files.com/5cdcb07b95678daa55f2bd83/635c647797c263283309177a_Home%20Office%20Guide%20(5).png)