Home office tax deduction still available, just not for COVID-displaced employees working from home - Don't Mess With Taxes

Home office tax deduction still available, just not for COVID-displaced employees working from home - Don't Mess With Taxes

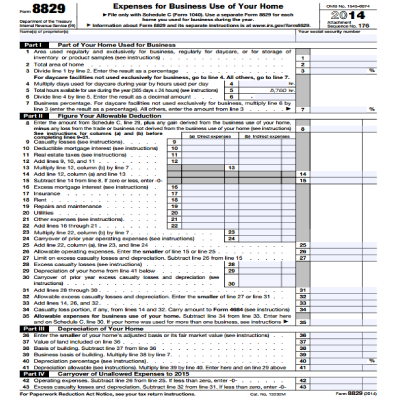

Home-based businesses have simplified way to claim home office deduction – Arizona Daily Independent

Gilbert AZ Small Business Accounting Firm BASC Expertise - Reliable Tax And Accounting Services For Individuals And Businesses