programming - Why does the closed formula result for a Barrier option price deviate so strongly from the Monte Carlo approximation? - Quantitative Finance Stack Exchange

Barrier option valuation with binomial model Binomial model Barrier options Formulas Application. - ppt download

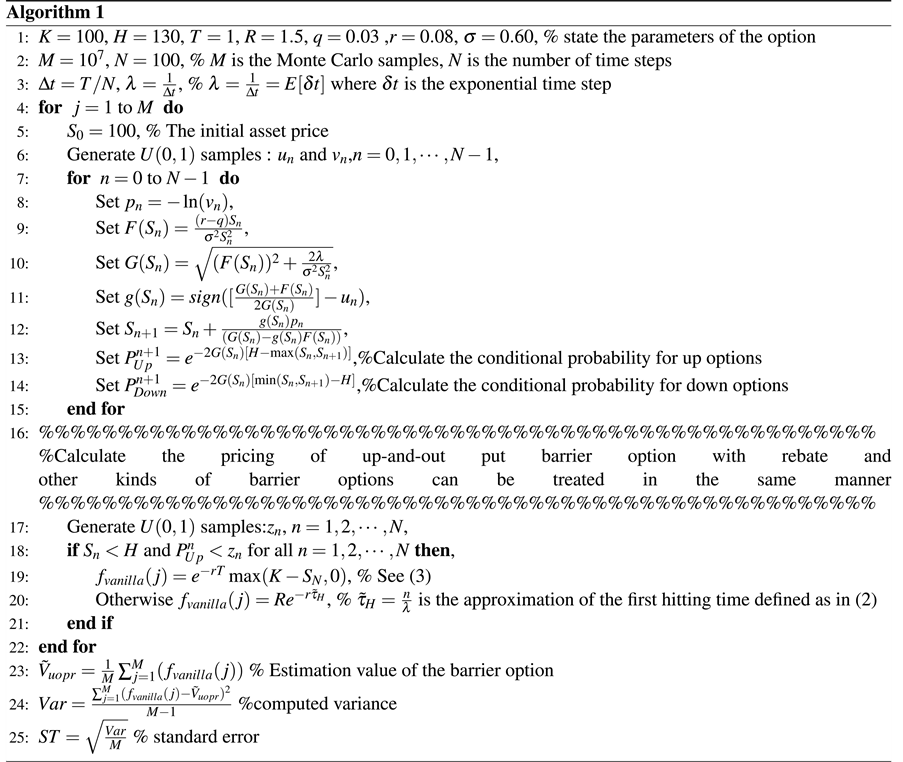

Random Timestepping Algorithm with Exponential Distribution for Pricing Various Structures of One-Sided Barrier Options

Bounds of barrier options. Notes: S 0 is the current market price of... | Download Scientific Diagram

MATH2022 - Solving Black-Scholes Equations for Barrier Option Pricing using, Werry Febrianti - YouTube

The numerical simulation of the tempered fractional Black–Scholes equation for European double barrier option - ScienceDirect

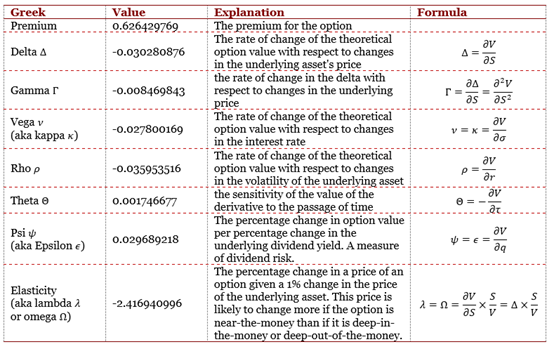

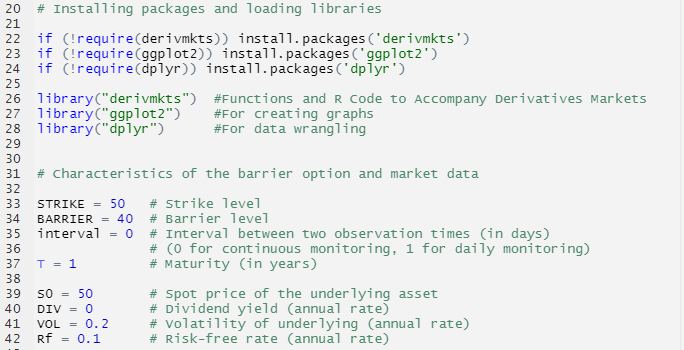

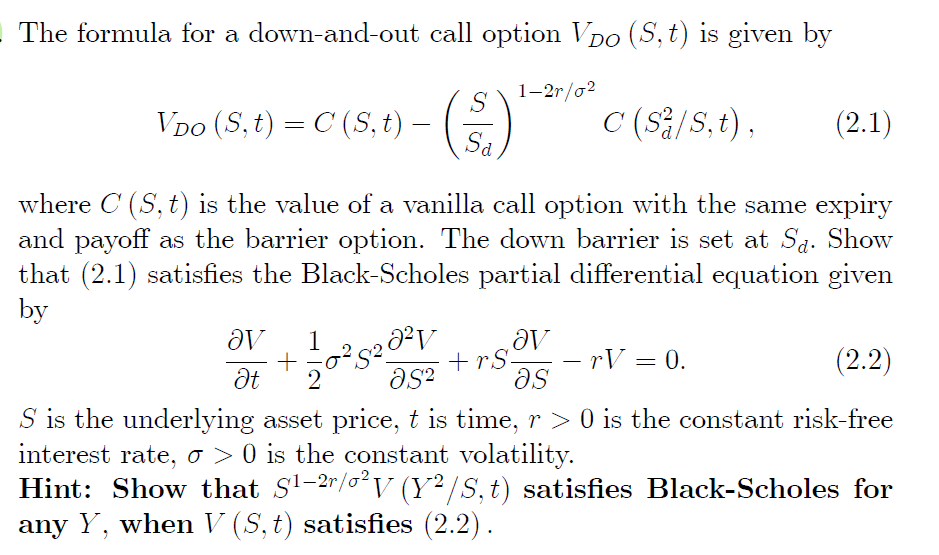

barrier - Valuation Down-And-Out Put Option via Rubinstein Closed-Form Solution - Quantitative Finance Stack Exchange

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

:max_bytes(150000):strip_icc()/dotdash_INV_final-Down-and-Out-Option_Feb_2021-01-2b26533c22b54c3088dacee7a4201d27.jpg)